We are always loosing money in Nifty option trading,because we always buy call&put option.90% of options are expired to 0. That's why we are advised to writing call options & put options. We are all miss understand option writing is unlimited risk. OPTION WRITING is no risk than options buying. Free Live Demo Call Us:- 09952420788

Wednesday, 27 September 2017

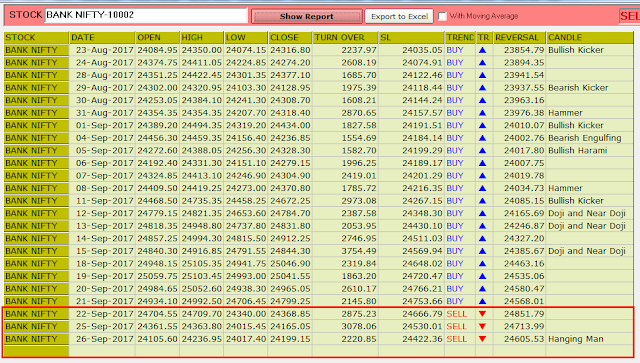

NIFTY & BANK NIFTY FUTURE POSITIONAL TRADING SOFTWARE TODAYS SIGNALS TODAY 27/09/2017.

NO CONFUSED TRADING.90% ACCURACY..

LIVE DEMO- 9952420788 - WHATSAPP

FOR FUTURE TRADERS.

NIFTY FUTURE POSITIONAL SELL @ 9920 NOW 9745 (+175)..

STILL IN DOWN TREND..

BANK NIFTY FUTURE POSITIONAL SELL @ 24200 NOW 23840 (+360)..

STILL IN DOWN TREND..

NIFTY FUTURE & EOD SYSTEM.

BANK NIFTY FUTURE & EOD SYSTEM.

STOCK FUTURE POSITIONAL TRADING SOFTWARE TODAYS SIGNALS TODAY 27/09/2017.

NO CONFUSED TRADING.90% ACCURACY..

LIVE DEMO- 9952420788 - WHATSAPP

FOR FUTURE TRADERS.

PFC FUT SELL BELOW 124.4 NOW 121 (+3.6) RS.21,600.

CADILAHC FUT SELL BELOW 470 NOW 460 (+10) RS.16,000.

TORNTPOWER FUT SELL BELOW 216.3 NOW 213.5 (+2.8) RS.8400.

REC FUT SELL BELOW 159.6 NOW 153.5 (+6.1) RS.36600.

POSITIONAL SIGNALS IN EOD SYSTEM.

1ST CONFORMATION.

POSITIONAL SIGNALS IN OUR CHARTING SIGNALS.

2ND CONFORMATION.

PFC FUT

CADILAHC FUT

TORNTPOWER FUT

REC FUT

Monday, 25 September 2017

STOCK OPTION WRITING (selling) -OTM CALL WRITING 25/09/2017

For Live Demo:

whats-app-9952420788

ACC

ACC WE GET A SELL SIGNAL IN OUR CHART & EOD SYSTEM ON 20/SEP/2017..

WE SELL ACC 1800 CE (OTM) @ 11 NOW .95(+10)...

ACC EOD SIGNAL

ACC POSITIONAL CHART

ACC OPTION SELLING(OTM)

JET AIRWAYS

JET AIRWAYS WE GET A SELL SIGNAL IN OUR CHART & EOD SYSTEM ON 15/SEP/2017..

WE SELL JETAIRWAYS 580 CE (OTM) @ 10 NOW .50(+9)...

JETAIRWAYS EOD SIGNAL

JETAIRWAYS POSITIONAL CHART

JETAIRWAYS OPTION SELLING (OTM)

Thursday, 21 September 2017

Wednesday, 20 September 2017

Covered call writing strategy- Coal India Ltd - Long Term Investment Ideas

For Live Demo:

whats-app-9952420788

Investor only making huge money in stock market.

whats-app-9952420788

Investor only making huge money in stock market.

we buy good fundamental stocks for long term and monthly make 2% to 10% without selling our holding.

Make Money Without selling your holdings.

Option sellers & Hedge Traders,Investors make monthly 5% to 10% .All are proper hedge trade...

covered call include generation of income without added market risk. The comparison between the covered call and simply owning shares of stock demonstrates that added covered call income discounts the basis in stock, thus reducing market risk.

Tuesday, 19 September 2017

MCX (COMMODITY) POSITIONAL TREND UPDATE 19/09/2017

FREE LIVE DEMO 9677750788

http://www.niftyoptionwriting.com

WHATS APP 9952420788

NO INTRADAY & NO CONFUSED BUY SELL SIGNAL.

CRUDE POSITIONAL BUY @ 3110 NOW 3208 (+98 PTS).

NATURAL GAS POSITIONAL BUY 195 NOW 202.3 (+7.3 PTS).

COPPER POSITIONAL SELL @439.3 NOW 422.55 (+16.75 PTS).

ZINC POSITIONAL BUY @ 197 NOW 200.4 (+3.4 PTS).

LEAD POSITIONAL BUY @ 147.6 NOW 152.5 (+4.9 PTS).

ALUMINI POSITIONAL SELL @ 133.2 NOW 132.8 (+.50 PTS).

GOLD POSITIONAL SELL @ 30000 NOW 29541(+459 PTS).

SILVER POSITIONAL SELL @ 40960 NOW 39742 (+1218 PTS).

NICKLE POSITIONAL SELL @ 760. NOW 714 (+46 PTS).

CRUDE

NATURAL GAS

COPPER

ZINC

LEAD

ALUMINI

GOLD

SILVER

NICKLE

Monday, 18 September 2017

Covered call writing strategy- Coal India Ltd - Long Term Investment Ideas

Make Money Without selling your holdings.

Option sellers & Hedge Traders,Investors make monthly 5% to 10% .All are proper hedge trade...

Option sellers & Hedge Traders,Investors make monthly 5% to 10% .All are proper hedge trade...

covered call include generation of income without added market risk. The comparison between the covered call and simply owning shares of stock demonstrates that added covered call income discounts the basis in stock, thus reducing market risk.

What is a covered call?

A “covered call” is an income-producing strategy where you sell, or “write”, call options against shares of stock you already own. Typically, you’ll sell one contract for every 100 shares of stock. In exchange for selling the call options, you collect an option premium. But that premium comes with an obligation. If the call option you sold is exercised by the buyer, you may be obligated to deliver your shares of the underlying stock.

Fortunately, you already own the underlying stock, so your potential obligation is “covered” – hence this strategy’s name, “covered call” writing.

Subscribe to:

Comments (Atom)